Reverse Sales Tax v1.0 – Find it in the Microsoft Store

————–

Sept 6, 2021

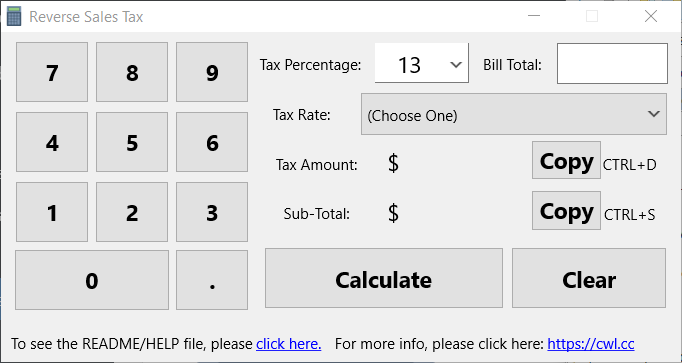

Reverse Sales Tax (RST) is a tool to calculate the tax amount on a final total. RST runs locally (offline) and helps streamline the process of data entry.

Usage:

Enter a value into the “Bill Total” field and either press the ENTER key or click the “Calculate” button. The tax value and subtotal value will be calculated and displayed on the screen.

Advanced Usage:

Upon every calculation, the “Bill Total” value will automatically copy to the clipboard. To copy the tax amount or subtotal amount to the clipboard, ensure RST is focused and use keyboard combinations CTRL+D (tax) and CTRL+S (subtotal).

To quickly choose a tax rate, use the included quick picker or enter a specific value in the tax percentage editbox.

Included Quick Tax Rates:

——————-

Alberta, Canada (GST): 5%

British Columbia, Canada (TAX): 12%

Manitoba, Canada (TAX): 12%

New Brunswick, Canada (HST): 15%

Newfoundland, Canada (HST): 15%

Northwest Territories, Canada (GST): 5%

Nova Scotia, Canada (HST): 15%

Nunavut, Canada (GST): 5%

Ontario, Canada (HST): 13%

Prince Edward Island, Canada (HST): 15%

Quebec, Canada (TAX): 14.975%

Saskatchewan, Canada (TAX): 11%

Yukon, Canada (GST): 5%

For more details please check out https://cwl.cc or email info@cwl.cc