We Need to Bring Cheques Into the 21st Century

Today, I had to deposit a cheque (or check-in America). As a business owner, this is a common occurrence. In the age of electronic transfers, NFC Payments, and Interac Online – we still use these pieces of paper to transfer money to each other. It’s high time the banks upgraded this process.

The cheque itself has been around forever – they themselves were created as an improvement in money. As long as I’ve ever banked, I’ve written and received cheques and had to decide between “savings” or “chequing” accounts. If you think about it, those two aren’t mutually exclusive.

But, as technology has improved on all forms of payment from NFC to Paypass to Tap payments, cheques are still a written or printed affair. Even more painful, the cheque generally requires a physical deposit. We have to go out to ATMs to put these items in an envelope and type out the amount on the cheque., or go super old-school and deposit them at a teller.

With money, you kind of have to be there. But with cheques, the banks really do have an opportunity to bring a serious level of efficiency to something every small business does.

What they need to do is make the cheque process a combination physical/electronic hybrid. Imagine writing a cheque and consulting your account by way of online banking or a mobile app. Here’s how I imagine an improved cheque-writing process.

In there you see your balance and start a cheque. You’ll type in who the cheque is to, and the amount (extra points for contextual awareness of recurring payments and offering to autocomplete). Afterwards, the app spits out a code. You’re going to write that code on the cheque when printing or handwriting it. As a bonus, the sender could scan that cheque and email it to the payee.

The receiver gets the cheque. They open online banking, or a mobile app, and open “receive cheque”. All that’s left is entering an amount and the code. The bank’s system verifies both sides, banking information, and places money in the account. The bank may request the actual paper cheque at a later time, so you hold on to it.

For companies with larger volumes of these cheques to deposit, all they have to do is scan all of them and email them to a bank email account that processes them.

No more “The check is in the mail”. No more runs to the bank. No more searching for your bank’s ATM hoping it supports deposits. If they aren’t going away (and I don’t think they are), cheques are seriously due for an upgrade. What do you think?

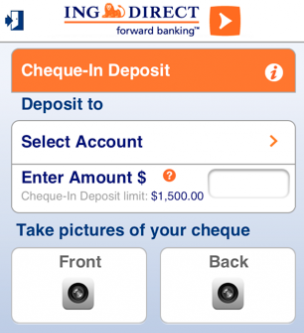

Update: Thanks to a tip from Alex, it appears that I’m not the only one that shares an interest in changing how cheques are used. ING Direct, a popular direct banking institution here in Canada offers smartphone cheque deposits with their mobile application. The process includes taking a photo of the front and back of the cheques and the amount of deposit is limited to a dollar amount over time.

Update: Thanks to a tip from Alex, it appears that I’m not the only one that shares an interest in changing how cheques are used. ING Direct, a popular direct banking institution here in Canada offers smartphone cheque deposits with their mobile application. The process includes taking a photo of the front and back of the cheques and the amount of deposit is limited to a dollar amount over time.

I consider this a great step forward, and a huge move by any Canadian bank to update a lagging process. Let’s hope we’ll see more of this in the future.

Update 2: The BBC has a story that banks are working on a technology that allows its customers to take pictures of cheques, send them in and have the cheque cashed. This is huge news! Let’s hope it gets over here.