TD Bank Seems Set on Becoming Canada’s Worst Bank

I don’t often blog about banking in Canada; Because let’s face it, I don’t want to put you to sleep. But, as I was reading today’s news, I came across an interesting turnaround by one of Canada’s larger banks: TD Bank. They appear to have been on a downward spiral of greed and customer gouging (the likes of which I don’t think I’ve ever seen).

More people should be talking about this. For most Canadians, we probably feel like something is wrong with how the banks operate, but there’s never been such an egregious example as we have now. And, let’s face it, doing business here in Canada is hard. You have to face a Government and their overbearing taxes, a difficult economy, and the banks are experts at squeezing away what’s left of your money.

Here’s a grim rundown of TD Bank’s recent history:

1. They hire new CEO Bharat Masrani in November 2014

2. TD Bank then cuts the payroll of some 1,600 TD employees

3. Mr. Masrani then gives himself a 10% raise (now making $9 million a year)

4. TD’s net income – yes after expenses – is $7.9 Billion at end of 2015

5. TD’s first-quarter profits for 2016 were $2.2 billion

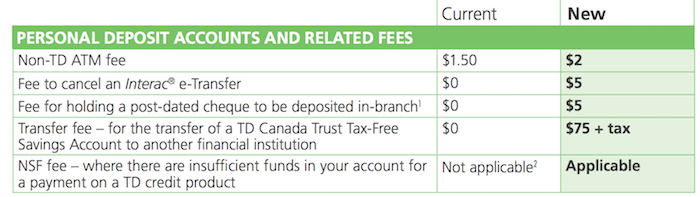

6. TD Bank raises a slew of fees on personal and business accounts starting March 1, 2016. Many of these fee changes are new fees or drastically increased fees on services [1].

If you’re a TD Bank customer, this should all make your blood boil. If it were me, it might motivate me to move to another bank. But, here’s the thing, in Canada, you’re mostly screwed. The big banks own every sort of banking option you have, and they all seem to be moving in the same direction (high fees and high profits with less service). Will the other banks follow suit? I’m certain they will if TD Bank is left unchecked.

What’s worse, the goodwill you may have built-in one bank will be completely wiped out if your account winds up somewhere else. There is more than your credit rating at stake, and the banks know this. It also seems clear that TD Bank has no problem charging its customers as much as possible, as it takes advantage of efficiencies that technologies afford them. When is the last time you saw a bank teller?

Myself? I have one product with this company, and I will cancel it immediately. I suggest you consider doing the same if you can. The most powerful thing we speak with is our wallets (in our own limited capacity). This may also be time for some sort of Government intervention or some other avenue of change.